|

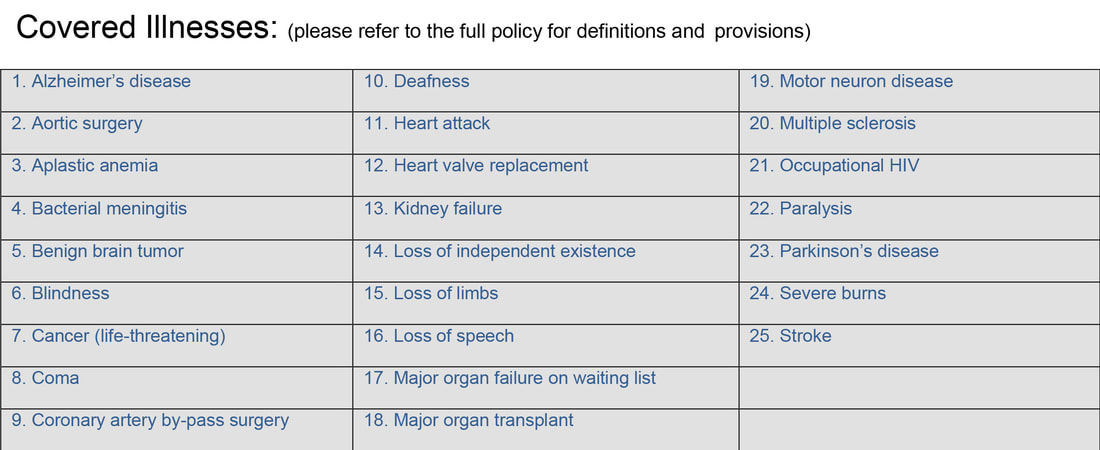

Valentine’s Day is around the corner, and with so much focus on matters of the heart, let's talk about how to protect it! Your heart pumps blood to all of our organs, and throughout our body, it beats low when we sleep and high when we exercise, and above all, it keeps us alive. With heart disease being the second leading cause of death in Canada and 40,000 Canadians having sudden cardiac arrest every year, it's safe to assume that you know someone in your life who has been affected by one of these heart conditions. Critical Illness policies can provide a lump sum payout if you survive the waiting period (30 days) after suffering a critical condition or being diagnosed with a critical illness. For example, if you were to have a heart attack, and survived the attack, and waiting period, you would be eligible for a lump-sum payment of whatever your policy was. Coverage is available from $25,000 to $1,000,000 and covers 25 conditions, including life-threatening cancer, kidney failure, multiple sclerosis, and strokes. If you've had a history of health conditions, you may think you will not qualify for Critical Illness insurance. However, at Broker Plus Insurance, we like to leave no stone unturned, so we have a No Medical Critical Illness product that can be placed for clients who may not qualify for our standard Critical Illness insurance. Clients can insure $5,000 to a maximum of $300,000 on this type of policy. Strokes, cancer and coronary surgery are covered under our No Medical Critical Illness policy.

Don't forget about the kids too! We have a Child Critical Illness Rider and a standalone Child Critical Illness policy to ensure the entire family is covered! To request a quote on the products we offer, click here. Or call: 1-877-242-8820 and press 3 to speak with an insurance coordinator.

0 Comments

|

Author

All blog posts are written from Cassie Meadows, a Broker Account Manager at Broker Plus Insurance. Archives

March 2021

Categories

All

|

RSS Feed

RSS Feed