|

At Broker Plus Insurance, we’ve noticed a trend lately with our clients when we speak to them about Term insurance. Many clients know the benefits of Term insurance over traditional lender insurance, but what they don’t know is that we offer 6 optional riders with our Term insurance. Two of the riders offer specifically pertain to children, which catches a lot of clients off guard when we mention this to them. What many of our clients don’t realize is that insuring their children when they take a term policy is by far one of the smartest things they can do. Should something happen to their child, they will have a policy in place that will help alleviate some of the financial hardships they may face while dealing with the loss of a child or a critically ill child.

If you’re considering term insurance, why not considering insuring your child(ren) as well? Broker Plus Insurance is proud to offer 2 Child Riders (Critical Illness and Protection Benefit), which ensures your child until the age of 21, or 25 if the child is a full-time student. When the insured parent’s base policy is converted, within the time frames stated in the Rider Conversion Option, then a similar rider may be included, at the owner’s request (subject to the rules in effect at the time of application for the converted insurance). The Child Critical Illness Rider:

The Child Protection Benefit:

**Stand alone child critical illness also available. To request a quote on the products we offer, click here. Or call: 1-877-242-8820 and press 3 to speak with an insurance coordinator.

0 Comments

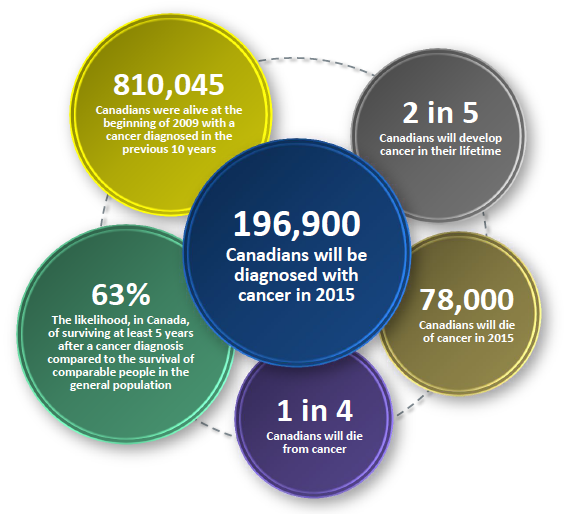

Image obtained from http://www.pattenfinancialservices.com/uploads/2/4/3/0/24302723/1891623_orig.png Being sick is something that no one ever enjoys dealing with. Whether it’s the cold or flu, there’s no denying that being sick sucks! However, imagine you are diagnosed with life-threatening cancer. For this illness, there’s no easy remedy and it often can mean a huge adjustment to take on lengthy treatment programs. This potential disruption to your life is something that many of us are not be prepared for.

Even conditions such as heart disease are easily overlooked by many people. An alarming fact is that 1 in 4 Canadians has some form of heart disease and an estimated 75,000 Canadians suffer heart attacks each year. Like I said, no one likes to think about being sick; so why not think about what you can do to prevent your loved ones from carrying the potential burden of a critically ill family member by insuring yourself before something happens? Often times, many of us don’t think about the need for Critical Illness insurance; or what it could mean to our income if we are forced to take sick leave and survive on reduced pay. Would you be able to continue to payment your mortgage commitment each month? Broker Plus Insurance is proud to offer many options for Critical Illness coverage to ensure that you and your family are protected, should the worst happen. Our stand alone Critical Illness coverage provides $25,000 to $1,000,000 of coverage if the insured person is diagnosed and survives one of the 25 defined critical illness conditions. These conditions include life-threatening cancer, stroke, Alzheimer’s disease, heart attacks, MS and Parkinson’s disease. We also offer a Critical Illness Rider for our Term insurance, which covers acute heart attacks, cancer, and strokes so long as the insured survives 30 days passed the date of diagnosis. For parents who want to ensure their children, we also offer a Child Critical Illness Rider for those who choose to take Term insurance. For enhanced protection, we have a standalone Child Critical Illness product that covers 37 illnesses and goes to the age of 75. Worried you may not qualify for our Critical Illness coverage? No problem, we have No Medical Critical Illness available! Click on the link below or give us a call today to gain more information about these products and how we can assist you with your insurance needs. To request a quote on the products we offer, click here. Or call: 1-877-242-8820 and press 3 to speak with an insurance coordinator. Term insurance is a product that has many benefits, especially if you are young, first-time home buyers who want to be placed with a policy that is best suited for your needs. Unfortunately, it is a product that many clients glance over in favor of traditional mortgage insurance. The benefits of Term insurance are best utilized while the client is young and healthy so that they can get the lowest rates possible.

As an example, we recently had a client (let’s call him Ned) who wanted to renew his term insurance through our company. Initially, Ned only took out a 10-year term with Broker Plus Insurance company at the age of 28, despite the fact that we also offer Terms of 20, 30 and 100 years. The issue that arises now when Ned renews his insurance is that he is rated at a higher age, hence his premiums have increased substantially. Had Ned taken a 30-year term, his premiums would not have increased until he renews his insurance at age 58. The most common thing we hear from our clients is that they want the best coverage possible for them and their family. For many of us, Term coverage is the best option for them as the coverage is renewable and convertible with no medical underwriting required when the coverage renews. We can also offer coverage from $25,000 up to 5 million to ensure that all of their insurance needs are being met. The other benefit your client has when choosing a Term insurance product through Broker Plus Insurance is that they have the option to choose 6 optional riders. These riders include:

Whatever your families’ needs are, let Broker Plus Insurance walk you through the benefits of our products and how we can protect your family, investments, and future. To request a quote on the products we offer, click here. Or call: 1-877-242-8820 and press 3 to speak with an insurance coordinator. Image obtained from https://blogs.zarget.com/5-cro-myths-debunked-2017.html Imagine this, you have just purchased a home that you’ve worked hard for and it’s time to consider whether or not to protect it with mortgage insurance. With all of the myths and negative publicity the insurance industry can get, it’s not hard to see why some people might be hesitant.

Here are some common insurance myths that we’ve debunked so that you can help make the right decision to avoid being faced with financial hardship in the future:

Whatever your families’ needs are, let Broker Plus Insurance walk you through the benefits of our products and how we can protect your family, investments, and future. To request a quote on the products we offer, click here. Or call: 1-877-242-8820 and press 3 to speak with an insurance coordinator. One of the common rebuttals we hear from clients when they choose to decline insurance is that they feel they have enough coverage from their workplace. We hear everything from: “I have great benefits,” “my husband is part of a union” and, our all-time favorite, “I’ll never lose my job.” However, what many of these clients fail to realize is that the coverage offered through their work is simply not enough when it comes to their insurance needs.

Many people are more likely to be underinsured through their work coverage. While most benefits packages come with some kind of life benefit, it is statically not enough to cover your entire mortgage if you pass away. Common amounts are $250,000 or double one year’s salary. Often times homeowners are not even aware of their benefit amounts! With gaps in coverage, many homeowners are leaving their families at risk to carry the burden of a mortgage they can no longer afford. Another aspect many people fail to realize is that their job is not 100% secure. Even if you are fairly certain that you are not at risk ask yourself; what would you do if you did lose your job 10 years from now? There are no guarantees your next job would provide the same benefits, nor how long it might take you to find a job and put those benefits in place. Perhaps 10 years later, you decide that you now do need mortgage protection. The issues that arise now are that you are 10 years older than when you first took out your mortgage, have a few health conditions and (let’s assume) have the additional rating of being a smoker. Would you be able to afford the high premium you would be forced to pay? Health problems could also force you to leave your job. If you relied solely or heavily upon group insurance, and suffer a medical condition that forces you to leave your job, you may be losing your life insurance coverage just when your family is going to need it the most. At that point, it would be too late to purchase your own policy at an affordable rate, if at all, depending on the medical condition. Finally, your plan may not provide enough coverage for your spouse. While your employer’s benefits package probably provides health insurance for your spouse, it won’t always provide life insurance for your spouse. If it does, the coverage could be minimal, $10,000 is a common amount, and that sum doesn’t go far when you lose your spouse unexpectedly. While having work coverage in place is better than nothing, it will likely fall short and leave you with either a hefty monthly premium down the road or your loved ones without the coverage they need. Consider looking at one of the products offered through Broker Plus Insurance to ensure that your mortgage will be protected in the event of a death, disability, job loss, or critical illness. We offer several different specialty products as well; including term life, critical illness (to age 75) and no medical products (if you’ve been declined for insurance in the past). We also offer child protection products in order to ensure all of your family’s needs are being met. Don’t rely on work coverage alone, contact us today for a free, no obligation quote! To request a quote on the products we offer, click here. Or call: 1-877-242-8820 and press 3 to speak with an insurance coordinator. Image obtained from https://www.humania.ca/en-CA/individual/about-us/contact-us Children can be several things: busy, messy, high-energy, loving, precious and ultimately our future. Every parent wants to ensure that their children are protected and insured for the rest of their life. Unfortunately, sometimes parents fail to see that the health coverage offered through their work or the government is not all inclusive. Often, when a child becomes critically ill, parents don’t account for unpaid time off, recovery time and other day-to-day expenses. This oversight can leave parents struggling financially to pay bills on time; which is the last thing a parent should worry about during these difficult times. Ensure that your children are protected with our new term insurance through Humania.

Humania has been in operation for over 77 years and has roots dating back to 1874. They officially became an insurance company called La Survivance in 1938. Recently restructured in 2012, it is owned by the policyholders through a mutual management corporation. Humania notes that too many families’ lives are shattered when their child is diagnosed with a critical illness. They believe this recovery time should be supported, along with your time away from work and the day-to-day expenses that are not covered by government programs. The main benefit of Humania products are:

To request a quote on the products we offer, click here. Or call: 1-877-242-8820 and press 3 to speak with an insurance coordinator. We are proud to announce that we have some new and exciting products available through our newest partner, Assumption Life. As a Canadian company that has been in business since 1903 and are committed to exceptional customer service. In fact, they are among the 50 Best Small & Medium Employers in Canada according to Aon Hewitt in 2015.

One of the most exciting features of this carrier is that your clients can now E-Sign! The application process can be completely paperless! This feature saves a lot of back and forth time to obtain signed original documents. In addition to that, we now have a family of personal insurance products that are ideal for people who are:

Application Process: With an application process so simple, you will avoid the lengthy hoops that most insurance carriers make you jump through. In many cases, there is an approval with 24 hours! Once you are ready to proceed we will have one of our licensed life agents take your application and payment information over the phone (days, nights or weekends). You will be sent a single authorization form that you can either e-sign or print, sign and return – your choice! Upon approval, we will notify you and send you full policy in the mail. If you are declined, you will be automatically offered one of their deferred coverage products. To request a quote on the products we offer, click here. Or call: 1-877-242-8820 and press 3 to speak with an insurance coordinator. Image obtained from Dollars and Sense http://dollarsandsense.sg/is-an-early-stage-critical-illness-plan-necessary/ For some folks, the concept of taking out insurance can be difficult and uncertain if they have had previous health issues which may make them unable to qualify for an insurance policy. Statistically, 1 in 10 Canadians has health and/or lifestyle issues which prevent them from obtaining coverage. The good news is we can help you with our accidental and no medical products!

Our personal insurance products allow people with health issues or who have been declined for insurance in the past due to pre-existing health conditions to qualify for insurance with no medical underwriting required. With Term Life, Critical Illness, and Disability, we have a wide range of products for high-risk people. Rates will be based on a short questionnaire with one of three rate classes, Bronze, Silver, and Gold. These policies can also be put in place as a temporary solution if you are working to improve your heath, weight, smoking status, etc. So don’t allow yourself to be discouraged if you have not qualified for insurance in the past. Let Broker Plus Insurance help to get you the coverage you deserve with one of our fantastic No Medical or Accidental products! To request a quote on the products we offer, click here. Or call: 1-877-242-8820 and press 3 to speak with an insurance coordinator. We have all been there, making New Year’s resolutions with every intent of sticking to them. Statistics from Forbes.com show that only 8% of people maintain or achieve their New Year’s resolutions, so don’t feel too bad about skipping the salad on your lunch break. However, there are some New Year’s resolutions that should not be ignored, many of these resolutions revolve around money. Perhaps, like me, you want to open an RESP for your little one(s) or start contributing more to a savings account such as an RRSP.

While these financial resolutions are fantastic, ask yourself this, if I were to suddenly pass away this year, will my family be left with a large mortgage or mountain of debt because I do not have insurance? Will my spouse be able to continue to pay for the mortgage and living expenses on her salary alone? Will my children’s health expenses be covered if they are diagnosed with a critical illness? If you answered no to one, or all of these questions, it may be time to talk to Broker Plus Insurance. We offer a wide range of products to protect you and your family from almost any situation. Some of the products we’re pleased to offer include Disability with optional Job Loss, Term Life, Child Polices, Critical Illness and No Medical coverage (for client’s who have been declined for insurance in the past due to health reasons). Our products were designed with one thing in mind, you, and more so, how the products can protect you should something happen. After 17 years in the mortgage business, we’ve seen the positive results of having these products in place before it’s too late. The smartest thing you can do for your family is to ensure that if something happens, they and yourself are protected with some type of insurance. Allow Broker Plus Insurance to be part of your New Year’s resolution by giving us a call today or requesting a quote with the link below! To request a quote on the products we offer, click here. Or call: 1-877-242-8820 and press 3 to speak with an insurance coordinator. There have been some big changes in Canada during the last few weeks. These changes are regarding the new mortgage rules that have been put in place by the Canadian Government. As of October 17, 2016, all insured mortgages (mortgages with less than 20% down) with a term of fewer than five years must undergo a “stress test” in order to confirm a borrower’s ability to continue to make mortgage payments at a higher rate.

What this means for homeowners is that they will be required to show they’ll be able to pay their mortgages at a rate of 4.64%. For some homeowners who had a non-insured mortgage (a 20% down payment), these new rules will not affect them. However, many homeowners who had a five-year fixed mortgage, for example, may have been previously qualified at 2.39%. Under the new rules, these homeowners will now be stress tested at the qualifying rate of 4.64%. How will this impact you? There are new criteria for conventional mortgages which homeowners must now follow. For example, a homeowner’s property must be owner occupied, hence rental properties are now excluded with these new rules. As well, the maximum amortization is now 25 years with a maximum property purchase of or below $999,999.99. Homeowners must also have a minimum credit score of 600 and a maximum gross debt service of 39% of homebuyers income and a total debt service of 44%. This is calculated by the Bank of Canada’s conventional five-year fixed posted rate. This also means that you may have to rely more on your mortgage broker to navigate them through these new changes. You may also have a harder time placing your first mortgage; which can be disheartening for your family, especially in today’s economy. This might mean that you will need to scale down the type of home that you had planned to buy. One upside to that is that it means you aren’t mortgaged to the hilt and can afford other things that are important in life, such as insurance. Recent statistics claim that 33% of Canadians do not have life insurance, and often times that is due to finances. Now is the best time to ensure you and your family are covered with life, disability and job loss insurance. With our programs, we are able to offer you different insurance options that are not currently offered through many lenders and banks. To request a quote on the products we offer, click here. Or call: 1-877-242-8820 and press 3 to speak with an insurance coordinator. |

Author

All blog posts are written from Cassie Meadows, a Broker Account Manager at Broker Plus Insurance. Archives

March 2021

Categories

All

|

RSS Feed

RSS Feed